Sukanya Samriddhi Yojana Calculator 2024:- The Sukanya Samriddhi Yojana Calculator for 2024 is now accessible online, enabling Indian citizens who hold Sukanya Samriddhi accounts to calculate the maturity amount under this scheme. This government-initiated scheme, designed to benefit the parents of girl children in India, offers an attractive interest rate higher than standard bank savings accounts. Only parents of girl children under the age of 10 can apply, making it an exclusive financial aid for securing a girl child’s future.

Table of Contents

Overview of Sukanya Samriddhi Yojana Calculator 2024

Launched in 2015 under the “Beti Bachao, Beti Padhao” initiative, the Sukanya Samriddhi Yojana (SSY) encourages parents of girl children to cultivate a habit of saving. With a minimum deposit of only INR 250, the scheme is inclusive for all, including low-income families. The maturity of the account is either after 21 years or when the girl child gets married after turning 18.

Key Highlights of the Sukanya Samriddhi Yojana Calculator

Here are some primary features of the Sukanya Samriddhi Yojana Calculator:

- Scheme Name: Sukanya Samriddhi Yojana Calculator

- Launched by: Government of India

- Launch Year: 2015

- Target Audience: Parents of girl children below 10 years

- Purpose: Promote savings for a girl child’s future

- Benefits: High interest rates, tax-free maturity, flexibility in deposits

- Documents Required: Aadhaar Card, Bank account details

- Application Process: Available online via the official website

Contact: 1800 266 6868

Key Benefits of the Sukanya Samriddhi Yojana

- High Interest Rates: The scheme offers higher interest rates than traditional savings accounts.

- Lump-Sum Savings: By investing regularly, parents can accumulate a significant amount for their daughter’s education or marriage.

- Tax-Free Returns: The maturity amount, including the interest, is tax-free under the Income Tax Act.

- Flexible Deposits: With a minimum deposit as low as INR 250, it caters to financially weaker sections of society.

Interest Rates Through the Years

The interest rates for the Sukanya Samriddhi Yojana have varied over the years. Below is a summary of interest rates since its inception:

| Financial Year | Date Range | Interest Rate |

|---|---|---|

| 2014–15 | 1 April 2014 to 31 March 2015 | 9.1% |

| 2015–16 | 1 April 2015 to 31 March 2016 | 9.2% |

| 2019–20 | 1 July 2019 to 31 March 2020 | 8.4% |

| 2020–21 | 1 April 2020 to 31 March 2021 | 7.6% |

| 2023–24 | 1 January 2024 to 31 March 2024 | 8.2% |

| 2024–25 | 1 April 2024 to 30 June 2024 | 8.2% |

How to Calculate SSY Interest Rate

The Sukanya Samriddhi Yojana interest calculation uses the compound interest formula:

A = P(1 + r/n)^(nt)

Where:

- P = Principal (initial deposit)

- r = Annual interest rate

- n = Compounding frequency

- t = Number of years

- A = Amount at maturity

This formula helps parents estimate the total maturity value, taking into account the power of compound interest.

Minimum and Maximum Deposits

The SSY scheme requires a minimum deposit of INR 250 and allows a maximum deposit of up to INR 1.5 lakh per year. This flexibility enables parents to save according to their financial capacity, accumulating funds efficiently over time.

Maturity Period and Withdrawal Rules

The maturity period of the Sukanya Samriddhi account extends to 21 years from the account’s opening or until the girl child’s marriage upon reaching 18 years.

Withdrawal Options:

- Higher Education: 50% of the maturity amount can be withdrawn when the girl child completes class 10 for educational expenses.

- Marriage: Parents may withdraw 50% of the funds for marriage expenses once the girl reaches 18.

- Medical Emergencies: Premature account closure is allowed in cases of severe medical conditions or death of a guardian.

Documentary Proof: Withdrawals for education or marriage require proof, such as a class 10 certificate or marriage certificate.

Steps to Open a Sukanya Samriddhi Yojana Account

- Visit a Post Office or Bank: Head to any authorized bank branch or post office.

- Consult with Officials: Obtain an application form for the Sukanya Samriddhi Yojana.

- Complete the Form: Enter all required details and attach necessary documents such as the birth certificate of the girl child and Aadhaar Card.

- Submit with Deposit: The initial deposit can range from INR 250 to INR 1.5 lakh.

- Receive Account Details: After submission, parents receive a passbook to track transactions.

Sukanya Samriddhi Yojana (SSY) 2024

The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme specifically for parents of girl children in India, designed to promote the financial well-being of daughters. Managed through the Post Office and banks like SBI, SSY offers one of the highest interest rates available for small savings schemes, making it an excellent choice for long-term investment.

Sukanya Samriddhi Yojana (SSY)

SSY allows parents to invest a fixed amount each year for their daughter’s future, such as higher education or marriage. The maturity period is either 21 years or when the girl reaches 18 and decides to marry. This scheme encourages parents to save consistently with the security of government backing and tax benefits under Section 80C.

Sukanya Samriddhi Yojana Calculator Options

Calculators help potential investors estimate the maturity amount and interest earned over the investment period. There are several options:

- Post Office Sukanya Samriddhi Yojana Calculator: Available on the official post office website, it lets parents compute their maturity value based on their annual or monthly deposits.

- SBI Sukanya Samriddhi Yojana Calculator: Offered by the State Bank of India, this calculator provides similar functionality, allowing investors to assess how much they’ll accumulate based on contributions.

- Year-wise Sukanya Samriddhi Yojana Calculator: For those interested in yearly breakdowns, this calculator shows year-on-year interest accrual.

- SSY Monthly Calculator: This version caters to investors planning monthly contributions. It helps in calculating monthly deposits and how they accumulate over time.

Each of these calculators can simplify financial planning, especially for those aiming for a specific corpus.

Sukanya Samriddhi Yojana Interest Rate for 2024

For the fiscal year 2024, the interest rate stands at 8.2%, higher than many other government savings schemes. Historically, the rates have varied slightly, but SSY remains a lucrative option. Here’s a look at some past rates:

| Financial Year | Interest Rate |

|---|---|

| 2019–2020 | 8.4% |

| 2020–2021 | 7.6% |

| 2021–2022 | 7.6% |

| 2022–2023 | 7.6% |

| 2023–2024 | 8.2% |

Calculating Sukanya Samriddhi Yojana in Excel

For those who prefer hands-on calculations, setting up an SSY calculator in Excel can be beneficial. To do this, use the formula:

[

A = P \times (1 + \frac{r}{n})^{nt}

]

Where:

- A = Maturity Amount

- P = Principal (initial deposit)

- r = Interest Rate

- n = Compounding frequency (yearly for SSY)

- t = Number of years

Using Excel’s formula functions, users can calculate the amount based on their specific deposits and time frame.

Post Office Sukanya Samriddhi Yojana with Monthly Deposits

For parents who wish to invest in smaller monthly amounts, the Post Office offers the flexibility to make deposits as low as ₹250 per month, up to ₹1.5 lakh annually. Many parents opt for a monthly deposit of ₹1,000 or more. Here’s a sample projection:

| Monthly Deposit | Years | Maturity Amount (Approximate) |

|---|---|---|

| ₹1,000 | 15 | ₹3.5 lakh |

| ₹1,000 | 21 | ₹6.8 lakh |

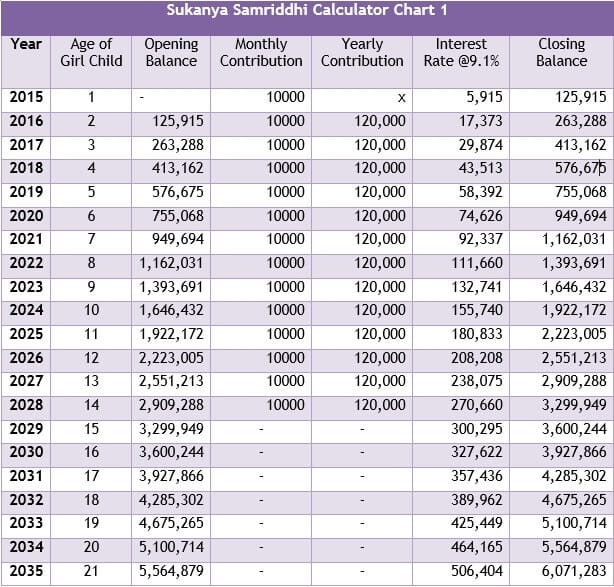

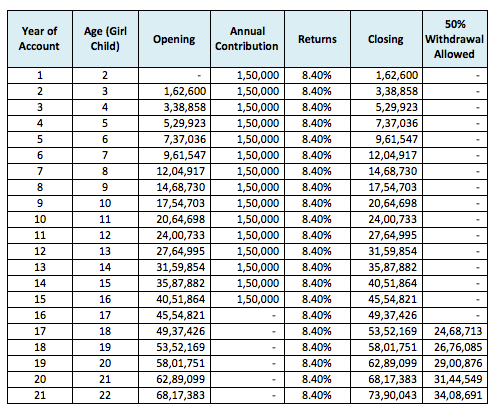

Sukanya Samriddhi Yojana Chart for Yearly Investment

Below is an approximate chart for yearly investments, assuming a consistent deposit and compounding effect over time:

| Yearly Deposit | Total Investment (21 Years) | Maturity Amount (Approximate) |

|---|---|---|

| ₹10,000 | ₹2,10,000 | ₹5.3 lakh |

| ₹25,000 | ₹5,25,000 | ₹13.5 lakh |

| ₹50,000 | ₹10,50,000 | ₹27 lakh |

SSY Withdrawal Rules

There are specific withdrawal rules under SSY:

- Higher Education: Once the girl child reaches 18, up to 50% of the balance can be withdrawn for higher education purposes.

- Marriage: Upon reaching 18, parents can withdraw for marriage expenses, but the account closes upon marriage.

- Emergency: In cases like severe medical issues, premature withdrawal is allowed with supporting documentation.

Tax Benefits and Exemptions

The SSY account is eligible for a tax deduction under Section 80C, and the maturity amount is tax-free, making it a triple-exempt scheme.

How to Open an SSY Account

Opening an SSY account is simple:

- Visit: Head to your nearest post office or bank branch.

- Complete the Form: Fill out the application with your child’s birth certificate, your Aadhaar card, and a passport-size photo.

- Deposit: Make an initial deposit between ₹250 and ₹1.5 lakh.

- Collect Account Details: You’ll receive an account number and passbook to monitor your deposits.

FAQs on Sukanya Samriddhi Yojana

Q1. Who can open an SSY account?

Parents or guardians of a girl child under the age of 10 can open the account.

Q2. Is the Sukanya Samriddhi Yojana Calculator available online?

Yes, calculators are available online through the official Post Office and major banks like SBI.

Q3. What is the interest rate for Sukanya Samriddhi Yojana in 2024?

The interest rate for SSY in 2024 is 8.2%.

Q4. Can I calculate monthly deposits with an SSY calculator?

Yes, monthly contribution calculations can be done using a Monthly SSY Calculator.

Q5. Is there a tax benefit on SSY?

Yes, contributions to SSY qualify for deductions under Section 80C, and the maturity amount is tax-free.

Q6. What is the maximum amount I can deposit?

The maximum amount you can deposit per year is ₹1.5 lakh.

Q7. Who is eligible for the Sukanya Samriddhi Yojana?

Parents or legal guardians of a girl child below 10 years are eligible to open an SSY account.

Q8. What is the current interest rate under the scheme?

The current interest rate for 2024 is 8.2%.

Q10. How is the maturity amount calculated?

The maturity amount is calculated using compound interest, with the formula: A = P(1 + r/n)^(nt).